We have successfully concluded the 2022 financial year and are continuing our stable development. Once again, our consistent course and our broad and solid international positioning with Retail, Travel and Tourism and Convenience have proven their worth in the face of the manifold effects of the war in Ukraine.

Total sales rose to a high level, partly due to inflation, while earnings (EBITA) fell slightly below the previous year's level. We were able to offset the negative effects on earnings - a deliberately calculated decline in food retail in Germany due to investments in customer prices, cost increases from energy, raw materials, personnel, logistics and targeted risk provisioning for individual investments, among other things - with positive contributions from other areas of the Group. This stable result was made possible above all by the strong return of Travel and Tourism following the coronavirus pandemic, but also by the good performance of our international business and Lekkerland. We not only continued our investment offensive in 2022, but also intensified it at a very high level.

Food retail Germany: Three-digit million euro amount invested in sales prices for customers

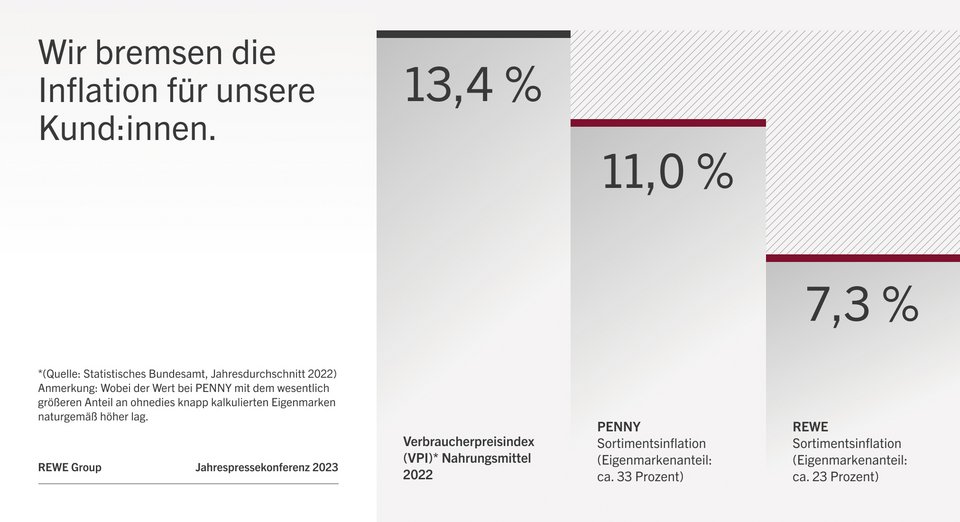

"We didn't leave our customers without an umbrella in the rain of inflation in 2022," said CEO Lionel Souque, honouring his promise. "In Germany alone, we have invested a three-digit million amount as announced. In doing so, we have effectively and verifiably stabilised our sales prices, consciously accepted a decline in earnings in the food retail sector in Germany and actively foregone profits." Assortment inflation, i.e. the price increases on REWE's shelves, was thus kept noticeably below the consumer price index, CPI, food 2022 of 13.4 per cent at REWE for customers at 7.3 per cent for 2022 as a whole, according to Souque.

Cooperative principles instead of maximising shareholder value

"By deciding to invest in our customers in the food retail sector, we deliberately sacrificed earnings. We were able to compensate for this thanks to the strong return of Travel and Tourism and the good performance of other Group divisions. We can do this because, as a cooperative, we are not driven by dividends, but instead focus on Sustainability and long-term growth - after all, we invest up to 99 per cent of what we earn in the further development of our business segments," emphasised Souque on the occasion of the publication of the unaudited company figures. This long-term orientation also includes, for example, the long-term portfolio management strategy of REWE Group's energy wholesale subsidiary EHA, which had mitigated the resulting cost increases by almost 150 million euros in 2022 in view of the skyrocketing energy prices in Germany. "And we have not scaled back or cancelled our investment offensive during the crisis like others. On the contrary, we have actually stepped up our investments in all business segments with a full focus on the customer requirements of tomorrow, modernisation, digitalisation, innovation and greening, with a total volume of 2.8 billion euros."

Solid financial strength ensures successful further development under its own steam

Overall, even after the last three years, which have been characterised by economic and socio-political extremes, we are in a very solid financial position. Souque: "Looking at the development of revenue, earnings, debt, equity and investments, we are in a position to continue our overall course consistently and stably under our own steam. The tactics, line-up and team are right." The fact is, however, that cushioning inflation-related developments - keyword investments in sales prices - can only be achieved temporarily, even for REWE Group. "We have to keep a very close eye on rising costs and our earning power with a low return on sales compared to other sectors. This is necessary - not least out of responsibility towards millions of customers across Europe, 384,000 employees, 10,000 partners and suppliers as well as our owners - in order to be able to make the investments in the medium and long term and to continue to develop economically as a company in the long term," explained Lionel Souque.

Overall, even after the last three years, which have been characterised by economic and socio-political extremes, we are in a very solid financial position. Souque: "Looking at the development of revenue, earnings, debt, equity and investments, we are in a position to continue our overall course consistently and stably under our own steam. The tactics, line-up and team are right." The fact is, however, that cushioning inflation-related developments - keyword investments in sales prices - can only be achieved temporarily, even for REWE Group. "We have to keep a very close eye on rising costs and our earning power with a low return on sales compared to other sectors. This is necessary - not least out of responsibility towards millions of customers across Europe, 384,000 employees, 10,000 partners and suppliers as well as our owners - in order to be able to make the investments in the medium and long term and to continue to develop economically as a company in the long term," explained Lionel Souque.

Customers rely on REWE retailers during the crisis: revenue increased by 6.4 per cent

REWE retailers increased their revenues by 6.4 per cent to 15.9 billion euros in this difficult environment. "The independent REWE retailers were able to score points even in an economically very difficult year for our customers; they are and remain the driving force behind REWE's success," emphasised Lionel Souque.

REWE Group increases revenue by 10.4 per cent

REWE Group's revenue increased by 10.4 per cent from 76.8 billion euros to 84.8 billion euros in the past business year: in Germany by 8.2 per cent to 58.6 billion euros (2021: 54.1 billion euros), abroad by 15.7 per cent (adjusted for exchange rate effects: +15.5 per cent) to 26.2 billion euros. The number of employees rose by 1.4 per cent to 384,239. In Germany, the number increased slightly (+0.2%) to 280,839, while the Group grew by 4.7 per cent to around 104,000 abroad.

REWE Group's revenue increased by 10.4 per cent from 76.8 billion euros to 84.8 billion euros in the past business year: in Germany by 8.2 per cent to 58.6 billion euros (2021: 54.1 billion euros), abroad by 15.7 per cent (adjusted for exchange rate effects: +15.5 per cent) to 26.2 billion euros. The number of employees rose by 1.4 per cent to 384,239. In Germany, the number increased slightly (+0.2%) to 280,839, while the Group grew by 4.7 per cent to around 104,000 abroad.

REWE Combine successfully navigates through crisis year 2022

REWE Combine's revenue from continuing operations - excluding independent retailers and at-equity companies - rose by 11.3 per cent from 69.4 billion euros to 77.2 billion euros last year. Sales growth in Germany was 8.7 per cent to 51.3 billion euros and abroad 16.8 per cent (adjusted for exchange rate effects 16.6 per cent) to 25.9 billion euros.

The operating result EBITA fell by 2.3 per cent from 1.49 billion euros (2021) to 1.45 billion euros, while the consolidated annual profit fell by 33.4 per cent from 755.6 million euros to 503.5 million euros.

The consolidated result of the international Group is characterised by two opposing developments. The deliberately accepted decline in earnings in Food Retailing Germany (REWE, PENNY), cost increases from energy, raw materials, logistics or personnel as well as the targeted risk provisioning for individual participations were compensated by other Group divisions, in particular the positive development in Travel and Tourism, supplemented by a good performance in international business and at Lekkerland.

At the same time, investment activity was further increased despite the crisis: investments in property, plant and equipment and intangible assets rose by around 520 million euros from 2.3 billion euros to 2.8 billion euros.

At the same time, investment activity was further increased despite the crisis: investments in property, plant and equipment and intangible assets rose by around 520 million euros from 2.3 billion euros to 2.8 billion euros.

Investments totalling 2.7 billion euros are planned for the current year. Equity rose by 8.5 per cent from 8.6 billion euros to 9.4 billion euros.

** English Version **

REWE Group ended the 2022 business year on a successful note and continues its stable performance. In view of the many different impacts of the Ukraine war, the consistent course and broad-based international structure (retail, travel and tourism, convenience) have once again paid off.

Total revenue rose - including for inflation-related reasons - to a high level, while the operating result (EBITA) was down slightly on the previous year's level. The negative effects on the results - deliberately costed decline in food retail in Germany by investing in customer prices, cost increases from energy, raw materials, staff, logistics and risk provisions for selected equity investments - were offset by positive contributions from other parts of the group. This stable result was driven especially by the strong comeback of travel and tourism after the coronavirus pandemic, as well as an encouraging trend in the international business and at Lekkerland. REWE Group's investments were not only continued in 2022, but intensified at a very high level.

Food retail in Germany: three-digit million sum invested in costumer prices

"We did not leave our customers out in the rain without an umbrella in 2022", says Lionel Souque, CEO of REWE Group, making good on his promise. "As announced, we invested a three-digit million sum in Germany alone, effectively and verifiably stabilising our customer prices and deliberately accepting a decline in the result in food retail in Germany and actively foregoing profit." Calculated for 2022 as a whole, product range inflation - i.e. price increases on REWE's shelves - was kept at 7.3 per cent at REWE, which for customers was noticeably lower than the consumer price index - CPI - for food of 13.4 per cent in 2022, explains Souque.

Cooperative principles rather than maximising shareholder value

"By investing in our customers in food retail, we took a conscious decision to forego profit. The strong comeback of travel and tourism and the good performance of other parts of the Group helped us offset the decline. We can do that because, as a cooperative, we are not driven by dividends, but aim to maintain sustainable business practices and generate long-term growth. We ultimately invest up to 99 per cent of what we earn in developing our business segments," emphasises Souque upon publication of the as yet unaudited financials of the company in Cologne. He added that this long-term focus also included, for example, the portfolio management strategy of REWE Group's wholesale energy trading subsidiary EHA, which in response to skyrocketing energy prices had cushioned the resulting cost increases by almost 150 million euros in Germany in 2022. "And unlike other players, we did not scale back or discontinue our investments during the crisis. On the contrary, with a complete focus on what our customers want for the future - modernisation, digitalisation, innovation and greening - we even increased them across all business segments to a total volume of 2.8 billion euros."

Solid financial strength secures continued successful organic growth

Overall, after three years of economic and socio-political extremes, the broadly based international group of companies was in a very solid financial position, explains the CEO of REWE Group: "Given our revenue, results, debt, equity and investment performance, we are in a position to continue in the overall direction we have taken and remain on a steady course from our own resources. We have the right game strategy, composition and team." It was a fact, however, that even REWE Group can cushion inflation-driven developments - by investing in customer prices - only for a limited time. "Given the lower overall return on sales compared with other industries, we kept a very close eye on the continuing cost increases and our earnings power. We have to do so - not least out of a sense of responsibility to millions of customers across Europe, 384,000 employees, tens of thousands of partners and suppliers and our owners - to allow us to handle the investments in the medium and long term and to continue to develop the business on a sustainable financial basis," explains Lionel Souque.

Customers trust REWE retailers in times of crisis: revenue up 6.4 per cent

The revenue generated by the REWE retailers under the umbrella of the cooperative REWE Group increased by 6.4 per cent to 15.9 billion euros. "The independent REWE retailers were able to score, even in a year that was economically very difficult for our customers; they are and will remain the drivers of success for REWE," continues the CEO of REWE Group.

REWE Group revenue increases by 10.4 per cent

In the last business year, REWE Group's revenue rose by 10.4 per cent, from 76.8 billion to 84.8 billion euros. The cooperative combine grew by 8.2 per cent to 58.6 billion euros (2021: 54.1 billion euros) in Germany and by 15.7 per cent (15.5 per cent adjusted for exchange rate effects) to 26.2 billion euros internationally. The number of employees rose by 1.4 per cent to 384,239. In Germany, the number increased slightly (+0.2%) to 280,839, while the group's workforce expanded by 4.7 per cent internationally, to about 104,000.

REWE Group successfully navigates crisis year 2022

REWE Group's revenue - excluding independent retail and equity-accounted entities - from continuing operations rose by 11.3 per cent from 69.4 billion euros to 77.2 billion euros in the year under review. Revenue in Germany increased by 8.7 per cent to 51.3 billion euros and internationally by 16.8 per cent (16.6 per cent adjusted for exchange rate effects) to 25.9 billion euros.

The operating result (EBITA) was down 2.3 per cent from 1.49 billion euros (2021) to 1.45 billion euros, while combined net profit fell by 33.4 per cent, from 755.6 million euros to 503.5 million euros.

The combined result of the international group was driven by two opposing trends. The deliberately accepted decline in the result in food retail in Germany (REWE, PENNY), cost increases from energy, raw materials, logistics and staff, as well as risk provisions for selected equity investments were offset by positive contributions from other parts of the combine; contributing factors were especially the positive trend in travel and tourism, complemented by good performance in the international business and at Lekkerland.

At the same time, the combine further boosted its investment activities despite the crisis: Investments in property and intangible assets rose by around 520 million euros from 2.3 billion euros to 2.8 billion euros.