Sustainability and Finance will go hand in hand in the future: REWE Group is the first German food retailer to successfully make its debut on the capital market and issue a bond totalling 900 million euros. This goes hand in hand with the direct linking of our commitment to sustainability with corporate financing. Dr Klaus Wirbel, Head of Finance and Group Treasury, and Nicola Tanaskovic, Head of Corporate Responsibility, explain how this works in an interview. Plus: the basics of finance - technical terms explained.

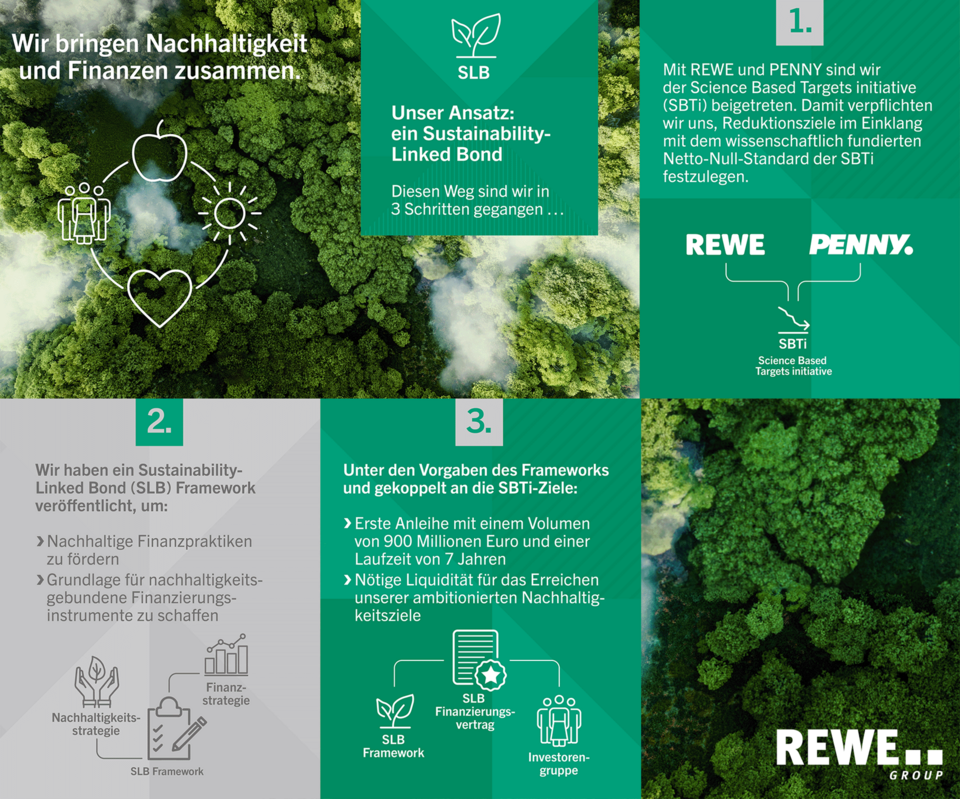

REWE Group has broken new ground in terms of its financing strategy: as the first German food retailer, we have not only successfully made our debut on the capital market and secured an investment volume of 900 million euros. We are also linking our commitment to sustainability with corporate financing.

This is because the bond is a sustainability-linked bond (SLB), the repayment amount of which at the end of the term is linked to the achievement of clearly defined and objectively verifiable sustainability targets. This strengthens our commitment to climate targets: REWE and PENNY in Germany have committed to setting medium and long-term company-wide reduction targets in line with the science-based net zero standard of the Science Based Targets initiative (SBTi). This commitment in turn forms the basis for the Sustainability-Linked Bond.

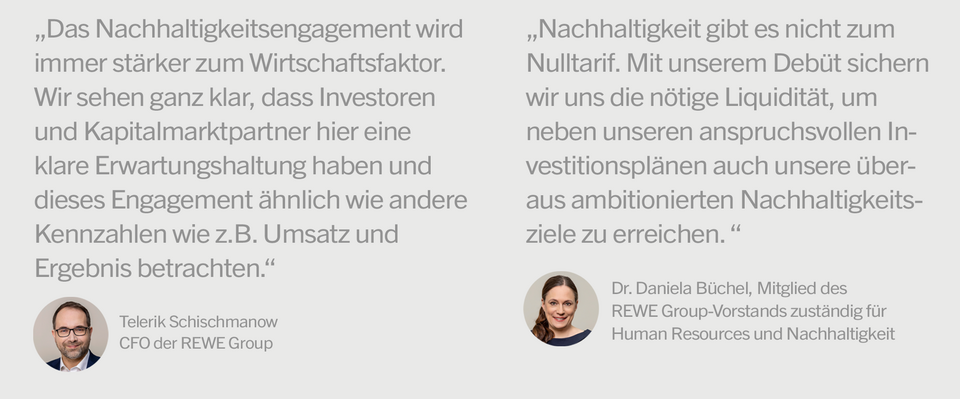

Telerik Schischmanow, CFO of REWE Group, comments: "Sustainability commitment is increasingly becoming an economic factor. We can clearly see that investors and capital market partners have clear expectations here and view this commitment in a similar way to other key figures such as revenue and earnings. Sustainability is not a luxury or the much-cited fig leaf. That is why we link our interest rate structure to our sustainability progress. The great confidence of our investors gives us the financial leeway to drive forward our growth and digitalisation course in parallel with our strategic development of Sustainability. In short: we are expanding the colour scale of the financial world from black and red to green."

"Sustainability doesn't come for free. With our debut, we are securing the liquidity we need to achieve our ambitious sustainability targets in addition to our ambitious investment plans. We will report annually on our progress. REWE and PENNY have made a company-wide commitment to set their medium and long-term reduction targets in line with the science-based net zero standard of the Science Based Targets initiative (SBTi). A feat of strength that we are facing up to and to which we are also committed in monetary terms," adds Dr Daniela Büchel, member of the REWE Group Management Board responsible for Human Resources and Sustainability."

Dr Klaus Wirbel, Head of Finance and Group Treasury, and Nicola Tanaskovic, Head of Corporate Responsibility, explain why REWE Group has placed a bond whose conditions are linked to sustainability targets and what the proceeds will be used for.

one: When it comes to product ranges and services, Sustainability has been at the top of REWE Group's agenda for many years. We have now linked our strategy for sustainable business with corporate financing and are the first company in the German food retail sector to successfully place a sustainability-linked bond. What exactly is that?

Klaus Wirbel: A sustainability-linked bond, or SLB for short, is a bond in which we promise investors that we will meet sustainability targets in addition to paying interest. Specifically, we have pledged to reduce the carbon emissions of those REWE Combine companies that together make up REWE Group's largest emissions, namely REWE and PENNY in Germany, by the end of the seven-year term of the bond.

The use of solar cells and modern refrigeration systems help to save energy in the stores. Copyright: © mauritius images | Westend61, Ok Shu, REWE Group | Achim Bachhausen

The use of solar cells and modern refrigeration systems help to save energy in the stores. Copyright: © mauritius images | Westend61, Ok Shu, REWE Group | Achim Bachhausen

Nicola Tanaskovic: We have set ourselves very ambitious targets: In terms of emissions resulting from our own business operations, for example from the consumption of electricity, heat and fuel for vehicles as well as refrigerant losses, we are aiming for a 42 per cent reduction by 2030. Experts refer to these emissions, which are largely under our own control, as Scope 1 and Scope 2, while Scope 3 refers to emissions caused by suppliers during the manufacture of products and by transport and packaging. Here, too, we are aiming for a reduction of 42 per cent by 2030, or around 30 per cent for the agricultural emissions that are the most difficult to address. Given the complexity of our supply chains, this in particular is very ambitious.

one: Why have we set ourselves these targets in particular?

Nicola Tanaskovic: With the chosen targets, REWE and PENNY in Germany are committing to ambitious and science-based climate targets in accordance with the latest standard of the Science Based Targets initiative (SBTi). "This recognised standard contributes to the targets set out in the Paris Climate Agreement. Several thousand companies worldwide are already registered with the SBTI.

„The issue of sustainable corporate development is also playing an increasingly important role for banks and investors.“

one: Why are we issuing such a sustainability-linked bond in the first place?

Klaus Wirbel : The issue of sustainable corporate development is also playing an increasingly important role for banks and investors. Investors want to know what the money is being used for and what the consequences of an investment are in terms of Sustainability. We would like to make an offer for these investors.

one: Do lenders reward the promise to meet sustainability targets with more favourable conditions?

Klaus Wirbel: The interest rate agreed in connection with the issue of the bond does not deviate significantly from the market level. However, an increasing number of investors are demanding financing instruments that are linked to sustainability targets. Those who do not make corresponding offers will soon find less and less resonance on the capital market. And a smaller offer usually means a higher price, i.e. a higher interest rate.

one: What happens if we don't achieve the agreed targets?

Klaus Wirbel: We have set interim targets along the way, which we review annually and also have audited. This creates transparency and shows us where we stand at all times. If, contrary to expectations, we do not achieve the final target, a premium - i.e. a surcharge - will be due at the end of the term of the bond.

one: Why didn't REWE Group decide to issue a green bond, i.e. a bond whose proceeds are used exclusively for sustainable projects?

Klaus Wirbel: The sustainability-linked bond gives us more freedom in the utilisation of the funds. REWE Group has a high investment requirement in order to meet the ongoing challenges and to master the extensive transformation requirements, not least in the areas of Sustainability and digitalisation.

one: What will the funds that our company receives from the bond transaction be used for?

Klaus Wirbel: The proceeds will help to finance upcoming investments, for example in the expansion of our logistics infrastructure, expansion or the acquisition of property as well as innovative projects..

„We will also use some of the funds to make our business even more sustainable.“

Green Buildings at REWE and PENNY

Green Buildings at REWE and PENNY

Nicola Tanaskovic:...and of course we will also use some of the funds to make our business even more sustainable. This includes the construction of green buildings, the optimisation of cooling technology and investments in sustainable construction. The conversion of the lorry fleet to alternative drive systems will also require a high level of funding, although these are not expected to be available on a significant scale for several years.

one: What role will sustainability-linked bonds play in REWE Group's future financing mix?

Klaus Wirbel: The bond market is a market that suits REWE Group's size. We are pleased to have gained access to this segment and would like to continue to be active there in the future. And of course we will always link potential further bonds to sustainability goals. We have decided in favour of this path and will not deviate from it. Our partners on the capital market also expect this. In future, however, we will also combine other financing instruments, such as bank loans, with a sustainability component where possible.

What actually is a bond? And how is it different from a share? What does sustainable finance mean and is a sustainability-linked bond the same as a green bond? After reading our little financing basics, you'll be able to have your say. We promise!

What is corporate finance?

What is corporate finance?

Corporate finance can be translated as corporate financing. In terms of content, corporate finance is concerned with planning, controlling and monitoring the financing (procurement of funds) and investments (utilisation of funds) in companies. The primary objective is to maintain the company's liquidity. For this reason, corporate finance considers all cash flows and ensures that these are planned and managed in line with the situation. Control mechanisms provide information on whether the planned values are being adhered to and whether the financial situation is stable.

What is a "bond" or a debenture?

What is a "bond" or a debenture?

Bonds are securities. They are usually traded on the stock exchange. When you buy a bond, you as the investor (subscriber) lend the issuer of a bond a sum of money for a certain period of time - you are effectively granting them a loan. As the buyer, you become the creditor, while the issuer becomes the debtor. As with a normal bank loan, the issuer must also pay the buyer interest on a bond.

The term and interest rate of the security are already fixed at the time of issue and are part of the so-called issue conditions of bonds.

What is the difference between shares and bonds?

What is the difference between shares and bonds?

A company has two options for raising capital: It can sell shares by issuing shares or issue bonds. Shareholders buy shares in a company, i.e. they participate in the company's equity. The buyers of a bond, on the other hand, are like lenders and provide the company with debt capital. Shareholders benefit from the success of a company through the dividend distribution - the subscribers of a bond benefit from the interest.

What is a coupon?

What is a coupon?

Coupon refers to the interest on bonds that is paid out to investors as an annual return. For example, a government bond with a coupon of 5 per cent p.a. promises annual interest of 5 per cent of its nominal value.

How do bonds work?

How do bonds work?

For example, when you buy a bond, you as the buyer pay the issuer a fixed amount, for example 100 euros. With a coupon of 5 per cent and a term of 5 years, you then receive 5 euros in interest every year. After 5 years, the issuer pays you back your 100 euros, thereby repaying its debt. You also receive another 5 euros in interest.

What does sustainable finance mean?

What does sustainable finance mean?

Sustainable finance is the English term for sustainable finance. As a collective term, it describes all financial services that pursue ecological, social and ethical goals in addition to economic goals.

What are "ESG criteria"?

What are "ESG criteria"?

The abbreviation stands for Environment, Social, Governance and has become established as a term for investments that should meet high standards in all three areas. The E refers to factors such as environmental protection, the reduction of greenhouse gases and energy and resource efficiency. S summarises aspects such as occupational health and safety, diversity and social commitment. G refers to the values to which a company is committed and the internal control and management processes, for example to prevent corruption. Numerous financial products bear the abbreviation ESG as an advertising label in their name. How well a company performs in the three dimensions of ESG has an increasing influence on its creditworthiness.

What is a green bond and what is the difference to a sustainability-linked bond?

What is a green bond and what is the difference to a sustainability-linked bond?

While the proceeds of green bonds can only be used for sustainable projects, sustainability-linked bonds (SLBs) can be used for any purpose. However, the amount of the financing costs depends on whether the issuer achieves the sustainability targets it has set itself.