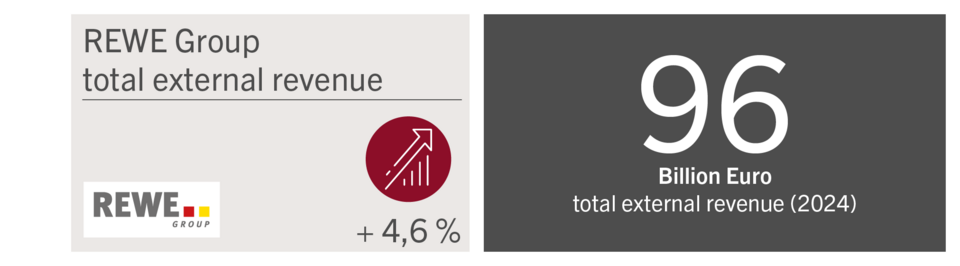

Despite subdued consumer sentiment and uncertain economic forecasts, REWE Group can look back on a successful business year and plans to invest 16 billion euros by 2028. All of our business segments contributed to a 4.6 per cent increase in turnover last year - despite a difficult environment. Where did things go particularly well - and in which projects will we be investing in the future?

REWE Group will invest 16 billion euros by 2028. Investments in all REWE Group stores will focus on driving digitalisation, expanding and modernising stores and infrastructure (IT/logistics) as well as real estate properties. "While other sectors of the economy are cutting back on investments or even giving up locations, we are strengthening Germany and Europe as business locations with our investments, which are also very high compared to other sectors. We promote national value creation and remain a strong, reliable economic engine even in difficult times," emphasised Lionel Souque, CEO of the REWE Group.

The 2024 financial year was a challenge. But we successfully faced up to the subdued consumer climate and the uncertain conditions across Europe. Lionel Souque summarises: "2024 was a good year for us, and this success is thanks to the hard and dedicated work of all our colleagues."

Over the past two years, we have already risen to the challenge of rising inflation - always with the aim of offering our customers exactly what they need and want. Despite economic uncertainties and consumers' high price sensitivity, we were able to continue our positive sales development.

Our international positioning as a group of companies with retail, Travel and Tourism and Convenience makes us particularly resilient. Telerik Shishmanov, CFO of REWE Group, emphasises: "All of our business segments contributed to revenue and earnings. We are still in good health as a company."

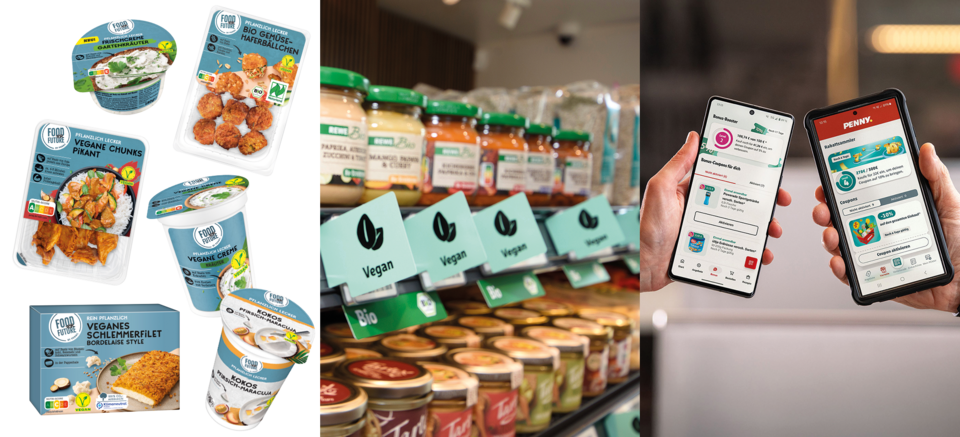

There are many reasons for this. Consumers increasingly bought special offers, entry-level price products and, above all, private labels. In Germany, both REWE and PENNY recorded significantly stronger growth in own-brand products than the branded segment. Organic products, regional and plant-based foods also featured more frequently on shopping lists. This trend shows that, in addition to increased price sensitivity, interest in more sustainable products is also growing - a development that we have anticipated at REWE and PENNY with targeted product range expansions.

Personalised and digital solutions contributed to an improved shopping experience. Customers also appreciated the tangible added value offered by the REWE and Penny apps, for example. This is clearly reflected in the customer figures: "With this focus in 2024, we have increasingly won over new customers and convinced them of our offers and services. Our REWE stores alone were visited by 7 million more customers per month than in 2023," explained Souque. The digital benefits programmes introduced by REWE and PENNY at the end of 2024 already exceeded all expectations in the first few weeks.

Individualisation, combined with special customer proximity and orientation, remains the recipe for success for our now 1,573 independent REWE retailers, who achieved a significant increase in sales in 2024. "Our retailers make an essential contribution to our success year after year. That's why we further strengthened and expanded the retailers model in 2024," emphasised Lionel Souque.

Overall, we can look back on stable sales growth at both REWE and PENNY. Our Convenience division in Germany also developed very favourably last year.

Travel and Tourism was one of the strongest growth drivers: the invoiced revenue of 8.7 billion euros (up 21.7%) is evidence of Europeans' unabated desire to travel in the past financial year. The tour operator brands of the DERTOUR Group were able to match the pre-pandemic guest numbers, and in Eastern Europe they were even higher. "Two trends are recognisable here: on the one hand, people are consciously taking a break from everyday life in the face of almost daily bad news. On the other hand, the increasing focus on experiences rather than material goods is fuelling consumers' desire to travel. We are responding to this with the right offers and the right teams, meaning that the DERTOUR Group has seen above-average growth," commented Lionel Souque on the strong growth.